CSC Digipay Commission Structure 2023

In the field of digital financial services, CSC Digipay plays a important role, empowering individuals and merchants to offer Aadhaar-enabled banking services to their customers. In this article, we’ll delve into the CSC Digipay Commission Structure for 2023, giving you a comprehensive understanding of how to maximize your earnings with the CSC Digipay Commission chart.

Unveiling the CSC Digipay Commission Structure

CSC Digipay doesn’t just provide CSC IDs; it also offers Digipay IDs, equipping VLEs (Village Level Entrepreneurs) with the capability to offer a wide range of Aadhaar banking services to their customers. At the core of these services lies AEPS, which is the linchpin of Digipay.

Through AEPS, VLEs can provide an array of services to their customers, including cash withdrawals, balance inquiries, and mini-statements. VLEs are rewarded with commissions for each AEPS transaction, and it’s vital to grasp the nuances of this commission structure.

Related Articles

AEPS Commission Structure

VLEs earn commissions on AEPS transactions, and these commissions vary based on the transaction amount. Let’s explore the detailed breakdown – CSC Digipay Commission chart –

- For transactions of up to 100 INR, VLEs receive a commission of 0.32 INR, as per the CSC Digipay Commission chart.

- For transactions ranging from 101 INR to 2000 INR, the commission varies from 0.72 INR to 7.92 INR, aligning with the CSC Digipay Commission chart.

- For transactions exceeding Rs. 2000 to Rs. 10000, VLEs can earn a commission upto Rs. 11.92.

| AEPS Transaction Amount | VLE Commission | TDS | Net VLE Commission |

| 100 | 0.32 | 0.016 | .304 |

| 200 | 0.72 | 0.036 | 0.684 |

| 300 | 1.12 | 0.056 | 1.064 |

| 400 | 1.52 | 0.076 | 1.444 |

| 500 | 1.92 | 0.096 | 1.824 |

| 600 | 2.32 | 0.116 | 2.204 |

| 700 | 2.72 | 0.136 | 2.584 |

| 800 | 3.12 | 0.156 | 2.964 |

| 900 | 3.52 | 0.176 | 3.344 |

| 1000 | 3.92 | 0.196 | 3.724 |

| 1100 | 4.32 | 0.376 | 4.104 |

| 1200 | 4.72 | 0.396 | 4.484 |

| 1300 | 5.12 | 0.256 | 4.864 |

| 1400 | 5.52 | 0.276 | 5.244 |

| 1500 | 5.92 | 0.296 | 5.624 |

| 1600 | 6.32 | 0.316 | 6.004 |

| 1700 | 6.72 | 0.336 | 6.384 |

| 1800 | 7.12 | 0.356 | 6.764 |

| 1900 | 7.52 | 0.376 | 7.144 |

| 2000 | 7.92 | 0.396 | 7.524 |

| 2100 | 8.32 | 0.416 | 7.904 |

| 2200 | 8.72 | 0.436 | 8.284 |

| 2300 | 9.12 | 0.456 | 8.664 |

| 2400 | 9.92 | 0.496 | 9.424 |

| 2500 | 9.92 | 0.496 | 9.424 |

| 2600 | 10.32 | 0.516 | 9.804 |

| 2700 | 10.72 | 0.01536 | 10.184 |

| 2800 | 11.12 | 0.556 | 10.564 |

| 2900 | 11.52 | 0.576 | 10.944 |

| 3000 | 11.92 | 0.596 | 11.324 |

| >3100 | 11.92 | 0.596 | 11.324 |

Additionally, it’s important to note that balance inquiries and mini-statements do not yield commissions. However, for cash withdrawals, VLEs can earn commissions of up to 12 INR, in accordance with the CSC Digipay Commission chart.

Digipay Payout/Settlement Charges

When it comes to settling transactions, CSC Digipay follows the standard industry practices. Transactions can be settled through IMPS (Immediate Payment Service) or NEFT (National Electronic Funds Transfer). IMPS offers a swift settlement process, often instant, whereas NEFT may take a bit longer, generally 2-3 hours.

The settlement charges are contingent on the amount being transferred, as specified in the CSC Digipay Commission chart. For transactions between 100 INR and 25,000 INR, there’s a 5 INR charge. For transactions exceeding 25,000 INR, the charge increases to 10 INR.

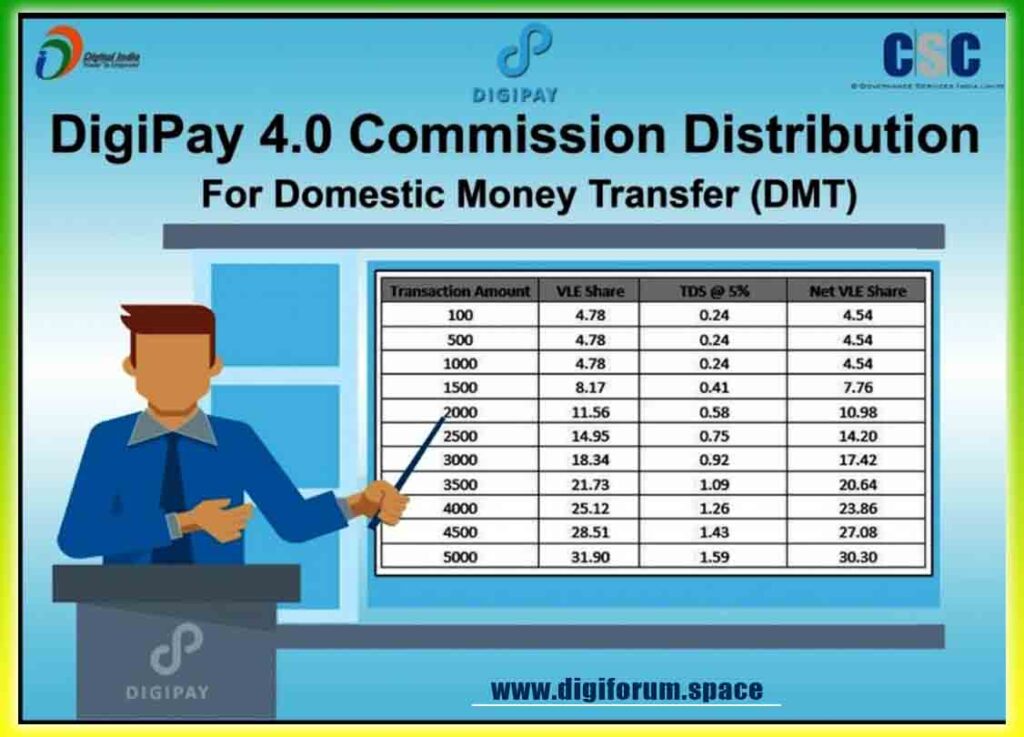

Digipay DMT Commission and Charges

Digipay also facilitates Domestic Money Transfer (DMT) services, allowing VLEs to offer money transfer services to their customers. Here’s a comprehensive breakdown of DMT commissions and charges, adhering to the CSC Digipay Commission chart:

- For transactions up to 100 INR, VLEs receive a share of 4.78 INR, in line with the CSC Digipay Commission chart.

- For transactions exceeding 100 INR, the share remains 4.78 INR, as per the CSC Digipay Commission chart.

- TDS deductions apply, amounting to 5% of the commission, in accordance with the CSC Digipay Commission chart.

- The final net share is the commission earned minus the TDS deductions, as per the CSC Digipay Commission chart.

Maximizing Your Earnings with CSC Digipay

Understanding the intricacies of the CSC Digipay Commission Structure is vital for VLEs looking to maximize their earnings, especially as it pertains to the CSC Digipay Commission chart. By optimizing your services, offering AEPS transactions, and actively participating in the financial ecosystem, you can leverage these commissions to boost your income.

FAQs – Frequently asked Questions and Answers

Q.: What is CSC Digipay, and how does it contribute to the digital financial services sector?

A.: CSC Digipay is a significant player in digital financial services, enabling individuals and merchants to provide Aadhaar-enabled banking services, thereby fostering financial inclusion.

Q.: Could you explain the role of AEPS in CSC Digipay, and how do VLEs benefit from it?

A.: AEPS (Aadhaar Enabled Payment System) is at the core of CSC Digipay. VLEs (Village Level Entrepreneurs) use AEPS to offer services like cash withdrawals, balance inquiries, and mini-statements to their customers, earning commissions for each transaction.

Q.: Do balance inquiries and mini-statements yield commissions for VLEs?

A.: No, balance inquiries and mini-statements do not yield commissions for VLEs. However, for cash withdrawals, VLEs can earn commissions of up to 12 INR in accordance with the CSC Digipay Commission chart.

Q.: How are transactions settled in CSC Digipay, and what are the charges involved?

A.: Transactions in CSC Digipay can be settled through IMPS (Immediate Payment Service) or NEFT (National Electronic Funds Transfer). IMPS offers swift settlements, often instant, while NEFT may take a bit longer, generally 2-3 hours. Settlement charges depend on the transaction amount, with a 5 INR charge for transactions between 100 INR and 25,000 INR and a 10 INR charge for transactions exceeding 25,000 INR.

Q.: What is the commission structure for AEPS transactions in CSC Digipay?

A.: The commission for AEPS transactions in CSC Digipay varies based on the transaction amount. For transactions up to 100 INR, VLEs receive a commission of 0.32 INR, while transactions ranging from 101 INR to 2000 INR offer commissions ranging from 0.72 INR to 7.92 INR. For transactions exceeding Rs. 2000 to Rs. 10000, VLEs can earn a commission of up to Rs. 11.92.

Summary

In conclusion, CSC Digipay opens the doors to a world of financial inclusion. Through AEPS and DMT services, VLEs can not only contribute to their communities but also earn commissions that reward their efforts.

Stay updated with the latest developments in CSC Digipay to ensure that you are making the most of the opportunities it presents. As the digital landscape continues to evolve, your adaptability and knowledge are your greatest assets in maximizing your earnings. Please note that commission structures and charges are subject to change, and it’s advisable to stay informed about the latest updates and revisions in the CSC Digipay system.